Télécharger le PDF

Dans leur dernier article publié sur le site de l’IATP (Institute for Agricultural Trade and Policy), Karen Hansen-Kuhn et Sophia Murphy reviennent sur la notion de dumping, ses causes et ses impacts. Ce billet qui se concentre essentiellement sur les États-Unis, et qui est reproduit ci-dessous, est lui-même issu d’un article scientifique détaillant plus avant les méthodes employées et le contexte historique du dumping.

Utilisant des données de l’OCDE et de l’USDA, les auteurs font référence à l’accord du GATT de 1947 pour justifier un calcul du dumping à partir des coûts de production et non des prix intérieurs. Si le cadre anti-dumping de l’accord de l’OMC de 1994 a été calqué sur celui du GATT de 1947, la jurisprudence OMC a en effet eu tendance à privilégier la définition du dumping basée sur la différence entre le prix à l’export et le prix sur le marché intérieur. La façon dont on considère le dumping à l’OMC, à l’exception notable du panel sur les produits laitiers du Canada en 2001-2002, est très contestable car le marché intérieur peut lui aussi être en situation de dumping.

Les calculs qu’elle ont réalisés montrent clairement que depuis le début des années 1990, les produits étudiés (coton, riz, soja, blé et maïs) ont été la plupart du temps vendus à des prix de dumping, c’est-à-dire sous les coûts de production. Pour le blé en particulier, seule la crise alimentaire de 2007/08 et ses répliques lui ont permis de ne pas être vendus à des prix de dumping.

Aux yeux des auteurs, ce dumping a trois effets négatifs. Premièrement « il porte préjudice aux producteurs » qui lorsqu’ils « ne récupèrent pas leurs coûts de production du marché, sont forcés de s’appuyer sur d’autres stratégies pour survivre ». Deuxièmement « cela affaiblit la viabilité des agriculteurs à l’étranger ». Enfin, « cela mine les objectifs environnementaux » car les agriculteurs ne sont alors pas en mesure d’améliorer leurs pratiques. Il est donc essentiel de s’attaquer aux racines de ce problème.

Pour remédier à ces effets délétères du dumping, Hansen-Kuhn et Murphy appellent à s’attaquer à la principale cause des prix bas à savoir le fait que les agriculteurs n‘ont, individuellement, pas intérêt à diminuer leur production y compris lorsque les prix baissent car la part des coûts fixes dans l’ensemble des coûts est importante à l’instar d’une industrie lourde. Dès lors, la priorité est à une « nouvelle approche du commerce international et des politiques agricoles ». Critiquant l’hypocrisie des États-Unis qui ont attaqué la Chine ou l’Inde à l’OMC pour leurs soutiens aux producteurs, cette tribune en appelle à davantage de coopération entre pays afin de développer des politiques stabilisatrices en synergie les unes avec les autres.

Christopher Gaudoin, Chargé de veille et d’analyse

The costs of agricultural export dumping for farmers and rural communities

Agricultural commodity dumping is the practice of exporting commodities at prices below the cost of production. Dumping cheats farmers both domestically and abroad and undermines crucial environmental goals in a time of climate crisis. The Institute for Agriculture and Trade Policy (IATP) has documented the extent of dumping of several key commodity crops for more than twenty years. IATP founder Mark Ritchie, with Gigi DiGiacomo, developed a calculation using a definition of dumping from the General Agreement on Tariffs and Trade (GATT, a precursor to the World Trade Organization) and data from the U.S. Department of Agriculture (USDA) and the Organization for Economic Cooperation and Development (OECD). They tracked production costs, prices at the farm and at the point of export, subsidies and estimated transportation costs for wheat, rice, corn, soy and cotton. Recently, we updated those calculations to better understand how global agricultural markets are functioning.

We found, with some exceptions, a consistent pattern of dumping from 1990 to 2017. As prices fell after price spikes in 2007-2008 and 2011, U.S. dumping on export markets resumed. As of 2017, the rates of dumping stood at 38 percent for wheat, 12 percent for cotton, nine percent for corn, four percent for soybeans and three percent for rice2. Despite the pause in dumping during those periods of high prices, the structural factors that allow dumping have persisted.

Dumping matters for at least three reasons. First, it hurts U.S. producers who sell their product into markets that are controlled by a handful of agricultural commodity trading corporations. When farmers cannot get back their production costs from the market, they are forced to rely on other strategies to survive, whether it is off-farm employment, government subsidies or under- valuing their labor. The economic consequences of low prices are felt by farmers and their families, their hired workers and by their rural communities, communities that are deprived of spending that would otherwise support vibrant economic life.

Secondly, it undermines the economic viability of farmers abroad, whether growing crops for domestic markets or selling to traders for export. Even producers in countries that do not import U.S.-grown commodities suffer because U.S. exports are large enough to affect world prices—which then impact all countries that trade some share of their agricultural production.

Thirdly, dumping undermines environmental goals. Care of the natural resource base, including the imperative to protect soil health, water quality and the ecological diversity of farmland, is squeezed when production is undervalued. Agricultural commodities that are sold too cheaply are bad for ecosystems around the world, whether at the micro level in the farm’s soil, at the level surrounding agricultural communities and their watersheds or in the global planetary systems human survival depends upon. International trade and investment link them all.

WHY DOES DUMPING HAPPEN?

There are three main driving factors behind dumping. One is the level of market power enjoyed by the agribusiness companies that provide inputs to farmers, buy commodities and then process those goods into food, animal feed and industrial products. Four firms dominate U.S. domestic agricultural commodity supply chains and the international grain trade: Archer Daniels Midland, Bunge, Cargill and Louis Dreyfus3. They are estimated to control 75-90 percent of global grain trade. In many markets, just one or two firms are present4.

Grain traders are heavily involved in commodity processing. They are vertically integrated in the market. This means that the costs at different stages of the commodity value chain remain internal to the firm’s operation, including the price of corn purchased on the commodity exchange, the price of the processed products made from that corn at the crushing plant and the cost of the grain provided to a feed lot operator for meat production.

In effect, agribusinesses that buy and process agricultural commodities have the market power to push prices below the level that would provide a reason- able profit to producers and then to appropriate value from other stages of the supply chain. The persistent gap between production costs and the price farmers receive is evidence the market is not self-correcting.

Government subsidies are the second factor. They make it possible for farm operations to continue by muffling price signals, which would otherwise push more farmers out of agriculture or would, in some other way, reduce supply. The continued production spurs more dumping. There is no question that without subsidies, many more U.S. farms would fail. The real question is whether fewer farms would reduce dumping, which is a factor of the volume of supply, not the number of farms in operation5. The long-term trend is toward consolidation and fewer, larger farms, a fact confirmed in the newly released 2017 U.S. Census of Agriculture.

The third factor links the market power of agribusiness and the government programs. Until 1985, when Farm Bill policies started to change, the U.S. government’s non-recourse loans acted as a buyer of last resort in the market. Farmers knew that if market prices were less than that foreseen when they borrowed money from the government for their crop, the government would accept that crop in lieu of repayment. This effectively created a price floor that the grain traders had to match or beat. With the elimination of the non- recourse loan and the eventual transition to revenue and price insurance, farmers lost a bargaining instrument against the market power of grain traders.

Graph 2 illustrates the relative production costs, subsidies and transportation costs for wheat. The pattern is similar for other crops. Both subsidies and dumping are linked to market prices, but they do not track precisely. Subsidies are not large enough, nor do they correlate closely enough, to fully explain dumping. The issue is not only the amount of the subsidies, but the incentives they create to produce massive quantities of certain crops, coupled with the effects of monopoly power6.

Farmers will forgo profit and maintain production in the face of losses for a long time. This is a long-observed fact of agriculture that is different than other sectors. Different explanations are offered for this behavior, including culture and community and family ties, as well as economic realities such as the lag that results from holding illiquid assets (land and machinery) and growing a commodity that cannot be produced “just in time.” Periods of high prices, if left unchecked, tend to stimulate an overreaction by farmers, resulting in more production than is demanded, thus leading again to lower prices.

As a result, over the last two decades, production has moved in two opposing directions: Toward larger farms and toward micro-farms that respond to emerging urban demand for locally grown produce. While the growth in more sustainable local production is a welcome development, small farms remain highly dependent on off-farm income Current Farm Bill programs react to price drops, but they are not designed to resolve them. They compensate farmers when there is a significant drop in commodity prices but do nothing to change the market structures that make farmers price takers in their markets, whether buying from the concentrated farm input supply sector or selling to commodity buyers. The result has been selling trade agreements and projected expanded exports as the way to grow markets and compensate for low prices. That response, though, has not solved farmers’ lack of bargaining power in relation to commodity traders and processors, most of whom buy from farmers around the globe.

The benefits of export-oriented agriculture tend to accrue to the largest actors, particularly the grain traders most directly involved in international markets. While farmers’ planting decisions are locked in seasonally (or even longer), grain traders can react very quickly to changes in markets. These companies have vastly superior access to information, an advantage that is likely to increase in the era of Big Data7. Although they have significant capital investments in commodity transport infrastructure, they can offset their risks with futures trading, and their global presence and market power gives them access to buyers and sellers around the planet. Grain traders can profit when prices rise or when they fall, as long as they successfully predict the direction of change. If the U.S. soy harvest fails, traders can source from Brazil or Argentina; if demand in China dips, they find customers in Malaysia. As importantly, grain traders are in the business of adding value to primary commodities, whether they are fattening animals with soy or turning corn into ethanol.

The risks inherent in agricultural production, such as unpredictable weather, fall on farmers. The risks of unstable markets, too, are a problem. Limiting production is not really an option if prices are expected to fall, as no individual farm is in a position to affect the market. This means farmers, quite rationally, tend to maximize production in the hopes that higher volume will compensate for lower prices.

THE NEW GLOBAL CHALLENGES

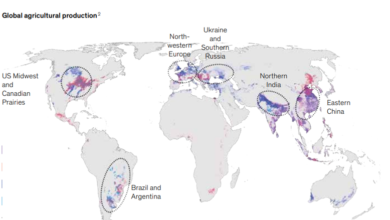

Agricultural markets have changed over the last 20 years. More food is grown, more food is traded internationally, and more countries are involved in growing and trading commodities. There are more people in the world, in part because more people are living longer lives and more have higher incomes. Asia has overtaken Europe as the largest food-importing region. At the same time, population growth in some of the world’s poorest regions has kept demand high for the three primary sources of calories worldwide— rice, corn and wheat. Meeting the steadily growing demand for food has exacerbated the unsustainable use of freshwater and topsoil and encouraged deforestation, while urbanization and climate change are shifting the geography of agricultural production and making output less predictable.

Agricultural commodity dumping diminished during periods of higher prices. Regions that depend heavily on commodity production and export profited from those prices. The benefits were also felt through higher government revenues and improved conditions on farms for producers and farm workers. But urban consumers suffered, and governments faced enormous political pressure to act quickly to bring food prices back down. In the aftermath of the price crisis, a range of policies—public investment in agriculture, private investment in land, price stabilization measures and social safety nets—received attention and funding8.

The food price crisis drew public focus to the vulnerabilities of globally interdependent food systems and the need for better risk management. Yet the resumption of low prices and dumping underscore the lack of progress in advancing comprehensive solutions that allow farmers to plan their production at fair and reasonably predictable prices. Most governments acknowledge that their food security rests on both local and international food systems. Therefore, it is essential that trade be governed by fair and transparent rules. A crucial first step is to protect food security from agricultural dumping.

While many in the U.S. would agree on the need for a better Farm Bill that ensures consumers get healthier food produced more sustainably, there is not yet consensus around programs to pay farmers fair prices and to rein in market concentration (although proposed legislation for a moratorium on agricultural mergers is a start). In any case, those measures will only succeed if there is also renewed attention to programs that build resilience against climate catastrophes or include managing stocks against supply or distribution shocks rather than simply seeking to export as much as possible for as long as possible.

The return to dumping occurs at a time when the U.S. is challenging other countries’ agricultural programs at the WTO. For example, the U.S. has challenged China’s support prices to corn farmers and India’s use of support prices for wheat and rice, leading other members to accuse the U.S. of hypocrisy.

There is an urgent need for a new approach to global trade and agriculture policies. New rules should respect the obligation of governments to protect food security at home, embrace the complex relationship of food systems to economic development and recognize the importance of accountability in domestic politics in rich and poor countries alike.

1 https://www.wto.org/french/tratop_f/adp_f/adp_info_f.htm

2 The government support cost and the cost of transportation and handling are added to the farmer production cost to calculate the full cost of production. The percent of export dumping is the difference between the full cost of production and the export price, divided by the full cost of production. Sources: Farmer production costs are from USDA Commodity Costs and Return. Government Support Costs are from OECD Producer Support Estimates Database. Transportation and export prices are based on information in USDA Agricultural Marketing Services Grain Transportation Report Datasets. For wheat, corn and soy, we used Table 2: Market Update: US Origins to Export Position Price Spreads. For rice we used Rice Yearbook, Table 17: Milled rice: Average price, f.o.b. mills, at selected US milling center. For cotton, we used the National Cotton Council of America’s A Index of global prices.

3 Mary Hendrickson and William Heffernan, Concentration of Agricultural Markets, vol. 21, p 311-328, University of Missouri, 2007 and Sophia Murphy, D Burch and J Clapp, Cereal Secrets, Oxfam, 2012.

4 Jennifer Clapp, Financialization, distance and global food politics, Journal of Peasant Studies 41, pp. 797-814, 2014.

5 Daryl Ray, Daniel de la Torre Ugarte and K Tiller, Rethinking U.S. Agricultural Policy. Agricultural Policy Analysis Center. 2003.

6 Hendrickson and Heffernan. Also see Claire Kelloway and Sarah Miller, Food and Power: Addressing Monopolization in America’s Food System, Open Markets Institute, March 2019.

7 P McMichael, The Global Restructuring of Agri-Food Systems, Cornell University Press. 2004. Pat Mooney, Too Big to Feed, IPES-Food. 2017.

8 Timothy Wise and Sophia Murphy, Resolving the Food Crisis. Global Development and Environment Institute and Institute for Agriculture and Trade Policy, 2012.