Cela est passé assez inaperçu de ce côté de l’Atlantique, mais les annonces de Trump s’inscrivent dans une démarche discutée notamment dans le cadre du G20 visant à réduire les surcapacités de production d’acier au niveau mondial. Les experts estiment en effet qu’au vu de la demande mondiale d’acier, les capacités de production dépassent de 16,5% leur niveau optimal, et ce en dépit de la réduction déjà opérée côté Chinois de l’équivalent de 11% de la capacité optimale2.

Steve Suppan en tire deux conclusions importantes : « la réaction des ‘libre-échangistes’ à l’annonce des protections douanières a été la panique, plutôt que l’analyse des raisons de la mise en place des droits de douanes », et si les Etat-Unis n’ont pas obtenu ce qu’ils souhaitaient c’est faute de contreparties attrayantes offertes à la Chine, car « les négociations de politiques commerciales […] ne sont pas une question de moralité mais de compromis ».

Aussi l’économiste pointe-t-il du doigt l’attitude peu constructive de son pays à l’OMC vis-à-vis des questions agricoles et alimentaires, sujet très sensible pour l’Empire du milieu. De même, alors que les Etats-Unis s’enfoncent dans la crise laitière, il dénonce les attaques américaines contre la politique laitière canadienne qui vise justement à maitriser l’offre, levier le plus direct pour éviter les problèmes de surcapacité. Enfin, citant que 82% des revenus des familles agricoles proviennent d’activités extérieures à l’agriculture, Steve Suppan appelle le Président Trump à s’indigner contre une crise de surproduction du secteur laitier qui amène les transformateurs laitiers à accompagner la paie du lait au producteur d’une brochure de prévention sur le suicide3.

Au final, on ne pourra rejoindre que Steve Suppan dans sa conclusion de remettre au gout du jour les outils de maitrise de l’offre pour le prochain Farm Bill : comme pour toute industrie lourde, l’ajustement par les prix n’est pas suffisant en agriculture comme dans la sidérurgie

Frédéric Courleux, Directeur des études d’Agriculture Stratégies

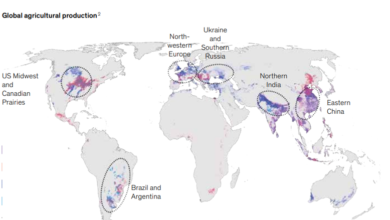

President Donald Trump’s announcement that he will apply tariffs to U.S. steel and aluminum imports—while temporarily exempting Canada and Mexico, and maybe other trading partners—is a partial and short-term solution to a real problem. Global oversupply of steel, aluminum and other commodities enables exporting companies to dump those goods at prices below the cost of production.

In a New York Times op-ed, Josh Bivens called the tariffs an “ad hoc and insufficient ameliorative fix for continuing policy failures that have decimated American manufacturing employment for almost two decades.” He’s right, but the long-term, macroeconomic fixes Bivins identifies don’t address the immediate cause of the tariffs.

The response of so-called ‘free traders’ to the tariff announcement has been to panic, rather than to analyze why the tariffs will be levied. Agribusiness exporters and farm organizations, which fear tariff retaliation will damage a U.S. agricultural economy already imperiled by years of below cost-of-production prices paid to farmers by agribusiness—according to U.S. Department of Agriculture calculations—have joined the trade lobby against the tariffs.

U.S. free traders have championed World Trade Organization (WTO) rules for protection of intellectual property, investors and more than 150 service sectors. WTO dispute settlement panels can authorize tariffs for dumping of industrial goods. These tariffs are calculated to offset the unfair price advantage of the dumped goods.

However, the Trump administration has repudiated not only the WTO dispute settlement process as unfair to U.S. companies, but multilateralism generally. It’s not surprising then that U.S. Trade Representative Robert Lighthizer’s attempt to negotiate a global compact on steel production overcapacity to reduce supply and increase prices has floundered because the agreement’s main target, China, has been offered nothing in return. Trade policy negotiations, as former WTO Director General Pascal Lamy once observed, are not about morality, but about trade-offs. But, as the USTR said of the WTO negotiations on agricultural subsidies, the U.S. has nothing it will trade off.

If trade policy were about morality, President Trump and the U.S. Department of Agriculture would be outraged at the severe harm caused by oversupply of dairy and other farm goods. U.S. dairy processors are sending farmers suicide prevention notices with meager checks for raw milk and a warning about low future prices. U.S. farmers dumped 43 million gallons of milkin the first eight months of 2016, rather than pay to transport it to receive more below cost-of-production prices.

If trade policy were about morality, Secretary Perdue and Congressional agriculture leaders would respond publicly to a February 25 Wall Street Journal article reporting USDA research showing 82 percent of U.S. farm family income comes from off-farm jobs, compared to 53 percent in 1960, the beginning of the free-trade era. As agricultural oversupply, below cost-of-production prices and high debt levels crush most farmers and ranchers, non-farm jobs, together with taxpayer subsidies, compensate partly for Farm Bill policy failure and agribusiness failure to pay above cost-of-production prices.

But because trade policy is not about morality, President Trump, Secretary Perdue and USTR Lighthizer advocate eliminating Canada’s dairy supply management program, which seeks to balance supply and demand, as antithetical to free trade in the North American Free Trade Agreement negotiations. Indeed, President Trump linked exemptions for Canada from the steel and aluminum tariffs to the elimination of dairy supply management.

According to the Canadian Dairy Information Centre, the value of Canadian dairy exports was CA $235 million (about US $181 million) in 2017. According to the U.S. Dairy Export Council (USDEC), the value of U.S. exports in January 2018 alone was US $400 million.

On July 26, former USDA Secretary Tom Vilsack, now USDEC’s CEO, testified to Congress, “Canada’s increasingly protectionist policies are diverting trade with attendant global price-depressing impacts, and are in conflict with the principles of free markets and fair and transparent trade.” Comparing the trade weight of U.S. and Canadian dairy export sales, the argument that Canada’s supply management program depresses global prices is preposterous.

Tariffs are an ad hoc, short-term response to the dumping of steel and aluminum into the United States. If Ambassador Lighthizer succeeds in forging a global steel supply management agreement, it will be because the United States offered appealing trade-offs. Eliminating Canada’s successful dairy supply management program will not begin to resolve U.S. farmers’ problems. For U.S. agribusiness to stop export dumping, the best way to do no further harm to U.S. farmers is to begin building supply management measures into the Farm Bill.

1 https://www.iatp.org/blog/too-much-steel

2 https://www.reuters.com/article/us-g20-steel/china-u-s-at-odds-over-steel-overcapacity-at-g20-forum-idUSKBN1DU1TQ

3 Voir aussi l’article : http://www.thebullvine.com/news/addressing-suicide-risk-for-dairy-farmers/