In a series of three articles, we are proposing additional insights on what is known as private risk management tools––futures markets and insurance against economic risks. In the first article published below, we are showing why these tools are mostly adapted when market prices regularly fluctuate around production costs, which is not the practice of agricultural markets. There are in fact two opposing representations of the functioning of agricultural markets: on one side, an ideal market representation (we then speak of “efficient markets”) where, thanks to the spontaneous adjustment of supply and demand, prices converge by themselves toward an equilibrium matching production costs; on the other side, a realistic view of agricultural markets, which are structurally unstable and whose prices accidentally meet production costs, resulting in cycles marked by “sparse spikes and wide slumps”1. The second article of the series will provide an analysis of operators’ strategies, the alliances and concerns by the promoters of private tools to manage risks. Lastly, the third article will cover the concerns and limitations of futures markets in the dairy sector.

No, futures markets and income insurances are not substitutes for public regulations. Unfortunately, one might say, since we are not talking about fueling academic debates, but finding solutions to the far-reaching consequences of agricultural price volatility. Yet, this is the conclusion reached by Jean-Marc Boussard, an economist specialized in agricultural risks, in a 2001 article in the publication Economie Rurale2, which is still extremely relevant today. Why? Because agricultural markets widely deviate from the blueprint of perfect markets where, by adjusting supply to demand, prices converge toward a balanced level––the “equilibrium price”3. As a result, actual markets are not as “efficient” as we might hope, and still quoting Jean-Mac Boussard, “actual prices only accidentally correspond to equilibrium prices”. In this context, the private risk management tools are very imperfect themselves to protect farmers, especially in times of soft markets. That is the case of futures markets as well as insurance benefits against economic risks, because insurers themselves rely on futures markets to offer this type of insurance contract, since price risks cannot be mutualized (for they affect all producers at the same time, and are therefore systemic).

Interesting tools to benefit from price volatility

Let’s start by considering the underlying rationale of using futures markets for farmers faced with price variation risks. The simplest plan is as follows: at sowing time, farmers commit to a price that is suitable for them and when it is crop harvest, they pocket the difference between the sowing price and the harvest time, if the latter is lower. Conversely, they must pay the difference in the opposite situation, which is of little matter to them since the crop is worth more. The issue might seem clear, but problems truly arise when there is no “suitable price” when they make their production choice. We then are presented with two specific cases. In the first case, one is saved since producers can benefit from rising prices during the season, either directly through the price proposed at harvest time, or (and one does not prevent the other) by presenting themselves as futures buyers or purchasing a “call” to gain from said price hike. In the second case, prices remain low for several months, or several years, and price variations and levels are so soft that futures markets are of no assistance: There is not enough volatility to be used.

Periods of low prices can be long-lasting

Unfortunately, these periods of low prices can last a long time, all the more so since adjusting supply to low prices is particularly lengthy in agriculture. We can list four reasons for this situation:

- The first reason is the very high level of competition between farmers, contrary to most sectors with high investments (such as energy or extractive industries) in which some operators in oligopolistic situations can see, by themselves, their interest in lowering production;

- The second reason, which is particularly valid for crops, is that even if the number of producers shrinks due to lower prices, production areas remain stable as they are taken over by survivors who continue to farm them;

- The third reason is linked to the previous two and depends on the production cost structure: when fixed costs are significant, producers have no interest in lowering their production since they will lose less by continuing to produce in order to “crush” their fixed costs, and even shoulder the low remuneration of the capital used and of their workforce;

- The fourth reason implies public policies. Confronted to low prices below production costs for almost all producers and their devastating consequences, public authorities generally intervene and reduce overcapacities by developing alternative outlets, by exiting international markets through customs duties, and granting direct subsidies (most often counter-cyclical support) or any all combination of the four levers. The problem then remains intact for producers in countries that do not have the budget resources or the political willingness (by ideology or by interest): they will have to assume the adjustment of all international trade.

Two opposing representations of agricultural markets

In the end and after explaining why prices might remain low, two representations of the functioning of agricultural markets become clearly evident and are opposed in all particulars. On one side, we have the premise of agricultural market effectiveness, which must be credited since 1971 to Eugene Fama, an economist and member of the prominent “Chicago School of Economics”, home of the neo-conservative counter-reform. In that situation, prices fluctuate sympathetically around production costs, adjustments are easily made since all agents have rational expectations, private risk management tools and futures markets are quite adequate to curb disturbances, and stabilizing agricultural policies are distortions that, at best, interfere with market adjustments.

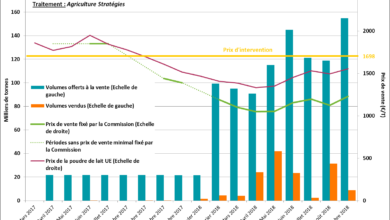

This ideal representation of agricultural markets––even this belief––has been the core driver of organizations such as the OECD and the WTO since the early 1990s, and is very often put forward by the experts following such inclination. Rather than calling it liberal, this approach can be labeled as neo-liberal or ultra-liberal. In fact, a true liberal in the economic sense of the term promotes a market economy when markets are functioning, and conversely organizes competition or corrects market failures so that markets operate better, while a neo-liberal prefers the status-quo, even when competition take the characteristics of the law of the jungle. The graph 1 below represents this functioning of markets where prices are supposed to fluctuate regularly around production costs with a short frequency.

Graph 1: Markets are efficient: prices are fluctuating around production cost levels

In view of this first representation, the second one takes into account a three-century old pragmatic and historical outlook of economic thinking regarding the causes and consequences of agricultural market volatility, from Britain’s Gregory King to the “Farm Problem” of T. Schutz and Cochrane and Ezekiel’s cobweb model in 1938. We must remember that this market representation and its related policy principles were widely prevailing up to the 1990s in the United States and in international organizations.

For a realistic representation of agricultural markets

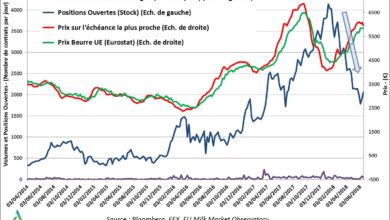

In this alternative way to represent them, markets are structurally unstable. Prices only randomly meet production costs, since fears of food insecurity can lead to very high prices and, conversely, a feeling of bounty and the above-mentioned reasons for the supply downward adjustment difficulties can keep them quite below their “equilibrium price”. We then experience cycles when, following an upward tension on prices inciting all producers to resume investments and increase production, supply exceeds demand, over-production and then stock resorption lasts 5, 10 or 30 years. The duration of the cycle depends on crops, the nature of production costs and above all on the public authorities’ (in)action.

In this realistic representation, we speak less of distortions than of market failures, since the latter denote all the reasons that prevent the spontaneous adjustment of supply and demand. Stabilizing agricultural policies are then perceived as the means to correct these failures, or reduce their impact at a minimum. In the end, in this second representation, futures markets only have a small relevance and cannot do much to exit the crisis, even by temporarily limiting the perception of the crisis and/or supporting a policy deadlock, it delays the search for an efficient solution.

Graph 2: Markets are structurally unstable and cyclical––infrequent spikes follow extensive slumps

In conclusion of this first article, it should be clarified that while private tools to manage risks are not substitutes to public regulations, they are nevertheless useful when we consider their complementarity with effective public regulations. Because they provide transparency to price setting, futures markets are crucial to the proper functioning of economic sectors when prices are not down over the long term. We will see in the third article that unfortunately some agricultural productions are not adequately organized so that this type of tools cannot truly emerge. To manage the intra-annual volatility in a short time frame, the usefulness of income or sales insurance benefits must no longer be questioned, as long as we do not strive to make use a tool in a manner for which it is not made, that is to say overcoming the bottom of a cycle.

Jacques Carles, Founder and chairman of Agriculture Strategies

Frédéric Courleux, Director of studies of Agriculture Stratégies

1 We take up this expression of a previous work of foresight conducted with Gilles Bazin in 2009: « Fiche-variable / prix agricoles internationaux », see page 149 of the complete document available here

http://agreste.agriculture.gouv.fr/IMG/pdf/CEP-Agriculture_Energie_2030-RapportComplet.pdf

2 Boussard J-M, (2001) Assurances et marchés à terme : similitudes et différences, Economie rurale, n°266, pp.119-129

3 The theoretical notion of equilibrium prices stems from the assumption of market equilibrium, in which case prices must be equal to the marginal complete production costs, ie the costs of the least competitive producers, but necessary to meet the demand.