China has one of the most interventionist agricultural policies in the world, and Chinese wheat remains one of the best-valued in the world1 despite a slight downward adjustment (-2.5%) in its domestic minimum price for the 2018 harvest. At 2,300 yuan per ton, or about 300 € / t, this guarantee is enough to leave European farmers dreaming,who have received around 130 € / t for their production over the past four years. The latter are indeed exposed to international markets, unlike the majority of other major producing countries that limit the exposure of their producers via countercyclical schemes or customs barriers. In this context, the position of European producers may be unsustainable in the event of prolonged price deterioration as decoupled subsidies continue to erode while being intended to meet other objectives. Taking into account the reality of the functioning of international markets whose prices do not reflect theoretical equilibrium prices but dumping prices, should be the basis of a strategic reflection to rethink the positioning of the European Union in trade exchanges of grains.

An assumed disconnection of international prices

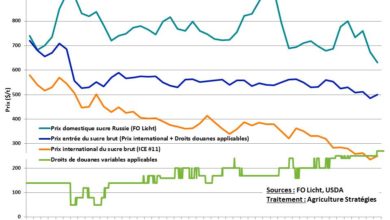

China has an agricultural policy based on price support. With variable customs protections and significant public storage capacity, China can indeed get out of the yoyo of international markets. As shown in the graph below, it has the ability to disconnect its domestic market from international prices, thus protecting against price spikes like the one of 2007/08 but also against the depression of the markets observed since 2014. This is valid for wheat and rice, the two productions at the base of Chinese food security for which China remains close to self-sufficiency. For soybean and corn, the situation is different: for the first, Beijing relies on imports to ensure its supply, the second, the adjustments made in 2016 have lowered the domestic price to about 240 € / t, with the reorientation of certain areas and the introduction of direct aids2.

Figure 1: Support price and market price in China for wheat (after Courleux and Depeyrot, 20173)

China is far from an exception

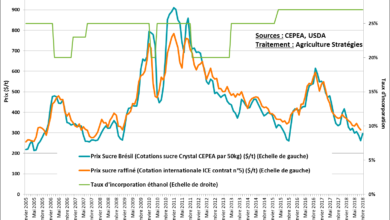

However, China is far from being a special case, the figure below represents the quantity produced (width) and the guaranteed minimum producer prices (height) for four of the largest wheat producing countries and representing 55% of the world production. Despite the slight decline in 2018, China has a much higher guaranteed minimum price than India, which follows the same principles with a guaranteed price of about $ 268 / t or the United States. whose producers have the opportunity to receive $ 202 / t by cumulating the perceived price and the counter-cyclical assistance offered by the PLC program. With a minimum price of € 101 / t, European farmers are therefore well below the level of protection, including adding the € 30- € 40 / t they receive via decoupled aid.

Figure 2: Wheat Production and Guaranteed Producer Prices in 2018

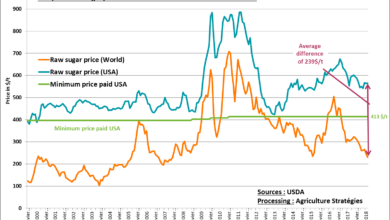

More broadly, there are three types of trade openness strategies for cereals. Demographic giants like China and India are disconnecting their domestic market from international prices for both food security and rural development issues. This is also the case for most net importing countries such as Egypt, Algeria or Iran. In contrast, exporters with vast plains such as Argentina (18.5 MT produced in 2017), Russia (73.6 MT in 2017) or Ukraine (27.1 MT in 2017) are directly connected to international awards, and in the end, they are the ones who “make the international awards”. And between the two is the United States and, to a lesser extent, Canada, which are opening up their trade, but giving their producers counter-cyclical assistance to protect them against too low prices.

A European strategy to question?

The world’s largest producer of wheat with more than 150 Mt produced, Europe finds itself in a deleterious strategy: the European domestic price depends on the international price and producers have fixed aids per hectare, independent of the real price level and are eroding while becoming counterparts to increasing environmental and societal standards. With an intervention price of only € 101 per tonne, the situation could even worsen further in the event of a further decline in international prices.

At this stage, two options need to be discussed in order to offer perspectives to a whole section of the European agricultural economy in the grip of the crisis. The first is to integrate into the CAP a countercyclical logic similar to what the United States has been constantly developing, a proposal that we have developed in particular in the Momagri White Paper “a new strategic course for the CAP »4. Otherwise, the second option would be to reduce the cereal sole to increase the production of oilseed crops in a Europe today largely dependent on imports of vegetable protein. It should be remembered that while net exports of all grains are about 25 million tonnes, soybean imports are about 35 million tonnes. This rebalancing would open up all the more interesting prospects for arable crop producers as the oilseed crops produced in Europe could benefit from a better valuation because of the rise in demand for differentiated fodder in animal feed ( local production, no GMO, etc.).

In the end, a conclusion is necessary for wheat as for most products: the international markets remain narrow, where the surpluses of a handful of exporters are exchanged, which induces price levels, outside the period of food insecurity, magnetized by the most competitive production costs. This reality of international prices – we are talking about dumped prices – contrasts with the theory of supply and demand, which would like international prices to correspond to the production costs of less competitive producers, but nevertheless necessary to satisfy demand. While the negotiation of the next CAP starts, it would be relevant to recognize this state of affairs in order to optimize the insertion of European agriculture in trade, because today the European Union is the only one to put forward the goal of connecting with international prices without having the competitive advantages of the Great Cereal Plains, nor the means to protect its producers against price volatility.

Frédéric Courleux, Director of studies for Agriculture Strategies

Christopher Gaudoin, Strategic analyst for Agriculture Strategies

1 See IGC bulletin : https://www.igc.int/_security/getfile.aspx?f=reports\gmr\483\jjj5rv\gmr483.pdf

2 See in particular http://www.momagri.org/FR/articles/Reforme-de-la-politique-chinoise-sur-le-mais-ajustement-ou-demantelement-_1799.html

3 Courleux F., Depeyrot J.-N., 2017, « La Chine, nouveau stockeur en dernier ressort après les Etats-Unis ? » in. Allaire G., Daviron B., (dir.). Transformations agricoles et agroalimentaires. Entre écologie et capitalisme. Versailles, Quae, coll. « Synthèse », 2017, 429p.

4 https://www.agriculture-strategies.eu/wp-content/uploads/2018/02/Livre-Blanc-2017-final.pdf