The abolition of the European sugar quota regime in 2017 did not have the expected results. The prospect of increasing European production to develop exports quickly turned into a drop in sugar prices and tensions in the governance of the sector, particularly in France. Heavy industry par excellence considering the transformation process, where the perishability and the heavy nature of the raw material explain the strong dependence between the links of the production and the first transformation, this sector also does not have important margins of maneuver to build a strategy of upmarket and “decommoditization”.

In these conditions, the exposure to the volatility of international markets, where the surpluses of the main producers are mainly exchanged, can undermine the entire sector because of a lack of strong public policy. In order to envisage a new regulatory framework for European sugar production, we propose a series of articles to study the different sugar policies of the main sugar producers. We will focus on Brazil, India, Thailand, China, the United States and Russia, which together with the European Union account for nearly two-thirds of world production (see Figure below). ). This panorama will allow us to conclude this series by constructing different scenarios of evolution of the European sugar policy.

Brazil is currently the world’s largest sugar producer with nearly 40 million tonnes, or 22.5% of world production in 20161. It is also the world’s largest sugar exporter, with 29 million tonnes of sugar when adding raw sugar (24Mt) and reffined sugar (5Mt). With 43% of world sugar exports, Brazil is the leading player in the international market, where it sells more than 70% of its production.

In Brazil, sugar is entirely derived from sugar cane cultivation. Cane production is highly concentrated in the south of the country, particularly in the state of Sao Paulo (Figure 1). The level of integration of production is high: 60% of cane production is directly produced by the sugar factories that hold the land or rent it2. The rest of the production is done by independent producers who engage in contracts covering one to two production cycles of 6 to 8 years each.

Figure 1: Distribution of sugar production in Brazil

Brazil’s sugar super power status was built thanks to strong state intervention in a country where the agricultural and agri-food sector account for 23.5% of GDP in 20173. The most widespread support in Brazil is the improvement of interest rates. This leverage is all the stronger in a country where normal rates are highjust like inflation, which reduces the burden of reimbursements.

Ethanol, the main outlet for cane

For the production of sugar, or more precisely for the production and processing of sugar cane, the main explanation for the development of the sector is to be found in the various regulatory frameworks that have succeeded each other since the 1930s in order to encourage the consumption of ethanol as fuel. Sugarcane can be processed into either sugar or ethanol. But if initially ethanol was seen as a complementary outlet to overcome the depressed international demand for sugar, the weight that has taken this outlet is now so great that the hierarchy between the two markets has been reversed. Indeed, if more than 70% of the sugar traded on the international market is Brazilian, in 2017 more sugar cane was transformed into ethanol (55%) than sugar (45%), and only 6% of the ethanol produced in Brazil is exported.

As Edouard Lanckriet4 explains, since its emergence in the 1930s, the regulatory framework for sugar-ethanol has been highly dependent on the price of oil and sugar: the most favorable periods for the political support of ethanol are those where oil prices are high and international sugar prices low.

Since 1930, the rate of incorporation of ethanol in fuels is indeed the main lever to adjust the energy market as an outlet for sugar cane, especially since the government still holds more than 50% of the votes in the board of directors of Petrobras, the key player in the Brazilian fuels market. In addition, the evolution of engines has raised the ceiling for the incorporation of ethanol in gasoline: in the first stages ethanol-only engines had developed, and then more importantly in the 2000s it is the development of flex-fuel engines that operate indifferently with pure ethanol or with a gasoline-ethanol mixture5. Thus, in 2017, while ethanol represents 45% of the fuels consumed in Brazil, 61% of ethanol is consumed without mixing it in aqueous form and 39% in mixes in its anhydrous form.

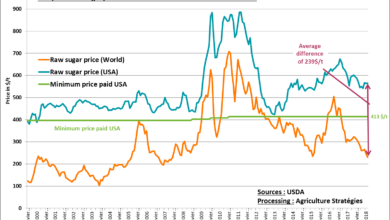

The rate of incorporation of anhydrous mixture ethanol into Brazilian fuels is therefore an important variable in the regulation of the international sugar market. As shown in Figure 2 below, this rate has fluctuated between 20 and 27% between 2005 and 2018. All things being equal, it appears that at this level, a 1% change in the rate of incorporation is translated by a reverse sign variation of 1.4% of Brazilian sugar exports6.

Figure 2: Evolution of sugar prices and ethanol incorporation rate in Brazil

As can be seen above, decreases in the rate of incorporation were decided in 2006, in 2009 and in 2011 during the run-up in sugar prices. Despite the current low prices, the rate could not be higher than 27%, which corresponds to the ceiling of non-flex-fuel engines. The rate of incorporation is indeed at its maximum and could only act as a stabilizer in the event of sharp increases in the price of sugar. It is therefore on the side of the increase in the fleet of flex-fuel vehicles that we can expect an increase in demand for ethanol.

In the end, Brazil’s sugar and ethanol policy highlights the interest and limits of market regulation instruments based on the development of an alternative outlet. It has the advantage of stabilizing markets as long as flexibility and responsiveness are sufficient to be part of a countercyclical piloting of markets. In this respect, Brazilian policy has been rather exemplary.

However, in the face of competitors who do not master (anymore) their supply of sugar for export, the action of Brazil alone to prevent sugar prices from settling in the depression will remain limited. Moreover, when an alternative outlet becomes the main valuation, the risk is high that the policy loses its original purpose of stabilizing markets. This is what we can fear from the announcement of the implementation from 2020 of the Renova Bio program by former President Temer, which aims to double the production of ethanol by 2030 via a fuel-specific carbon emission quota system.

Christopher Gaudoin, Strategic analyst for Agriculture Strategies

2 https://ageconsearch.umn.edu/bitstream/235655/2/AAEA_SantAnna.pdf

3 https://www.reuters.com/article/brazil-agriculture/brazil-agriculture-agribusiness-contributed-23-5-pct-to-gdp-in-2017-cna-idUSE6N1ND008

4 For a history of Brazilian sugar and ethanol policy, see the works of Edouard Lanckriet: https://www.agriculture-strategies.eu/2018/06/au-bresil-les-agroenergies-sont-un-outil-de-regulation-et-de-soutien-a-lagriculture-depuis-la-fin-du-xixeme-siecle/

5 Flex-fuel cars account for 80% of new-vehicle sales in the past 10 years and nearly 2/3 of the fleet in circulation in Brazil.

6 A 1% decrease in the incorporation rate equates to a 1 / 27th drop in anhydrous ethanol production in our hypothesis (in 2016: 432 Million liters). The cane thus released can pass through the sugar industry and using an average conversion rate for 1T cane for 120L of ethanol and 1T for 0.9 tonnes of sugar, there is a surplus equivalent to 1.4% of Brazilian exports. (327,700 tons)