Download the summary

Download the full study

Agriculture Strategies publishes a study of which we have reproduced the synthesis below. This study looked at the European sugar policy. It also includes all of our previous articles on the sugar policies of the world’s leading producers and exporters

While the European sugar sector is going through a crisis following the abolition of its regulatory tools, this study brings together the main elements of economic analysis to initiate a strategic reflection aimed at rebuilding a new European sugar policy.

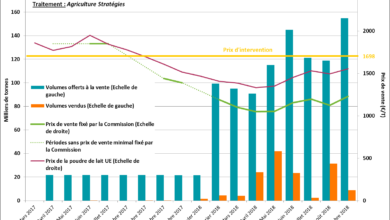

Third largest producer in the world, the European Union developed its sugar production thanks to a system of quotas and minimum prices established in 1968. Spared by the reform of the CAP of 1992, the European sugar policy underwent an important modification in 2006 to responde to the attacks from Brazil, which had seized the WTO for non-compliance with export subsidy reduction commitments.

The 2006 reform was a complete change of logic for the European sugar sector. Previously, exports were the adjustment variable to stabilize the domestic market and the volume of imports was under control. From that date, exports are capped and sugar production becomes adjustable to take into account less controlled import flows, all in a context where the development of biofuels offers a new outlet.

The 2006 reform quickly achieved its main objective: to satisfy Brazil, the world’s largest producer, by halting the export through dumping in order to boost international prices. For the European sugar sector, this strategic drop in European production has allowed production to concentrate in the most productive areas while retaining the protections to cope with the volatility of international prices.

In 2013, the decision to abolish sugar quotas was not subject to international pressure, but was taken in a context of collective euphoria due to high prices partly resulting from the decline in European production. The belief, unfortunately unfounded, in the ability of private crisis management tools – insurance and mutual funds – to compensate for greater exposure to the price level of international trade will also have played an important role in this decision.

The fall in European prices will not only have losers: the actors of the agri-food sector- Coca-Cola in mind – can now have access to a raw material essential to their business for a price lower than its cost of production, one more after cereals, dairy products, etc.

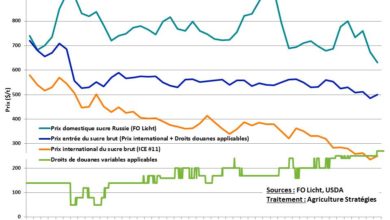

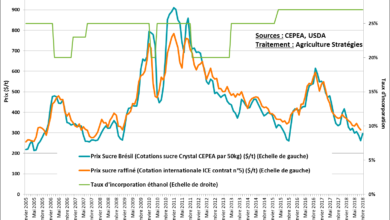

The deregulation of the European sugar market is all the more questionable since the examination of sugar policies in the other six main producing countries shows that sugar benefits from highly interventionist measures. There are still quotas in the United States and Thailand. China, India and Russia are protecting their domestic market with significant tariffs. In all countries, and particularly in Brazil, support for biofuels is also an important regulatory variable and is increasingly used.

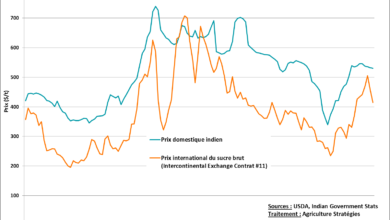

In the end, it appears that we cannot speak of “world sugar prices” since the European Union is the only major producer country to be directly connected with the export price of Brazil. The theory of international trade teaches that the market returns by itself to the equilibrium price that equals the production costs of the least competitive producers but necessary to satisfy all the demand. This is not the case, and as for other productions, it is the surpluses of the most competitive country that magnetize the international price most often at its level of dumping.

The analysis of the volatility of international sugar prices shows that the flexibilisation and coordination of different biofuel policies is a major subject. Everything happens as if with a stock level corresponding to 127 days, nearly 4 months, the market consideres that we were close to a shortage and, conversely, with the equivalent of 6 months of consumption, the market becomes depressed and prices at teir lowest.

The difference between these extremes is only 2 months of consumption, about 32 million tons. Therefore if we take the pivot value of 5 months of consumption as an adequate stock level, it appears that with a stabilizer flywheel of 16 million tons, we would be able to rebalance the fundamentals of the international market. This stabilizer flywheel converted to ethanol represents only 0.34% of annual oil consumption.

As it stands, the future of the European sugar industry is highly uncertain. If, in the short term, the decline in production will reduce exposure to international trade and hope for a rise in prices, a new Community policy remains to be rebuilt. The European Union cannot turn its back on its responsibilities for the security of its sugar supply, the stabilization of international trade and the development of renewable energies to prepare the post-oil era.

In conclusion, it is urgent that the European Union seize a twofold priority: rebuilding the European sugar policy while participating in the stabilization of international trade where it occupies a decisive position.